Lines 33 - 36 Center for Agricultural Law and Taxation

4.8 (242) · $ 18.50 · In stock

Farmers total all expenses reported on Part II of the Schedule F and report the total on Line 33, Schedule F. Example 1. Georgia has $652,435 of total allowable farm expenses this year. She reports this total on Line 33, Schedule F. Net farm profit or loss is reported on Line 34, Schedule F. This is calculated by subtracting Total Expenses (Line 33, Schedule F) from Gross

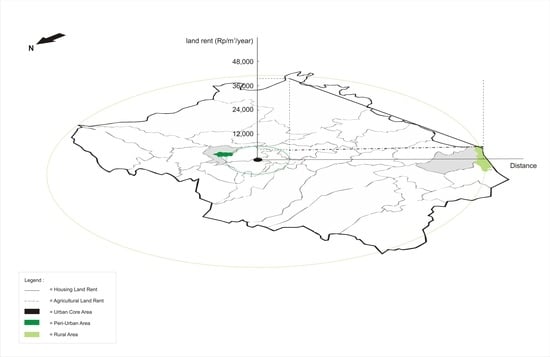

Land, Free Full-Text

2024 commercial real estate outlook

Lebanon's Environmentalists and the Fight for Nature: Reflecting on Successes and Failures of Recent Mobilizations – Arab Reform Initiative

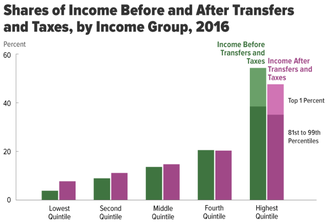

Income inequality in the United States - Wikipedia

Framing and Themes of the City of Boulder's Sugar-Sweetened Beverage Tax Coverage in the Local News From 2016 to 2018 - AJPM Focus

Ten Challenges for the UN in 2022-2023

image.slidesharecdn.com/esriindia-revenuecollectio

:max_bytes(150000):strip_icc()/Screenshot2023-12-14101210-777d825ead72468587c3d238dfe0fe1c.png)

Federal Income Tax

Siemens Mobility to invest $220 million into North Carolina rail manufacturing facility, Press, Company

Sales taxes in the United States - Wikipedia

Your Federal Income Tax For Individuals, IRS Publication 17 2023

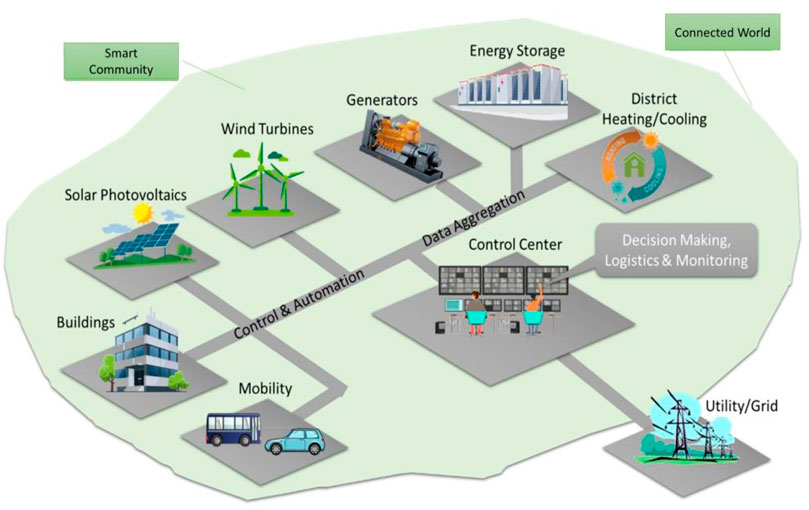

Frontiers Accelerating the Change to Smart Societies- a

Gold Dome Report - Legislative Day 36 - March 2024

Iowa Survey Shows Farmland Owned Debt-Free by Baby Boomers Who Like Cash Rent