Australian Government Bonds - Bond Adviser

4.9 (392) · $ 24.00 · In stock

Commonwealth Government Bonds (CGS) are medium to long term debt issued by the Treasury through the Australian Office of Financial Management (AOFM). These securities pay a fixed coupon semi-annual in arrears, which are redeemable at face value on the specified maturity date and are the most liquid fixed income security in the Australian. Bonds issued

:max_bytes(150000):strip_icc()/full-frame-of-us-patriot-treasury-bonds-647036948-5a936b10eb97de003765a6dc.jpg)

How to Build Your Own Bond Portfolio

Treasury Bonds, SmartAsset

Semi Government Bonds - Bond Adviser

Bonds Marketplace - Fixed Income

How Do I Trade Bonds? Interactive Brokers LLC

Why are Bond Yields High for Aussies? – Forbes Advisor Australia

Vanguard Australia says bonds are the 'standout asset class

Big Treasury Rout Lures Fresh Buyers - WSJ

Active Sovereign Bond Strategy - Coolabah Capital Investments

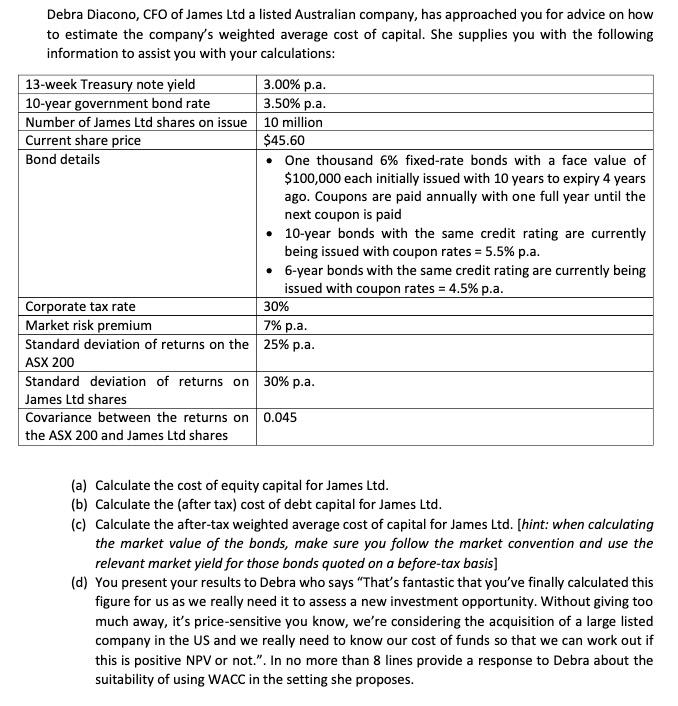

Debra Diacono, CFO of James Ltd a listed Australian