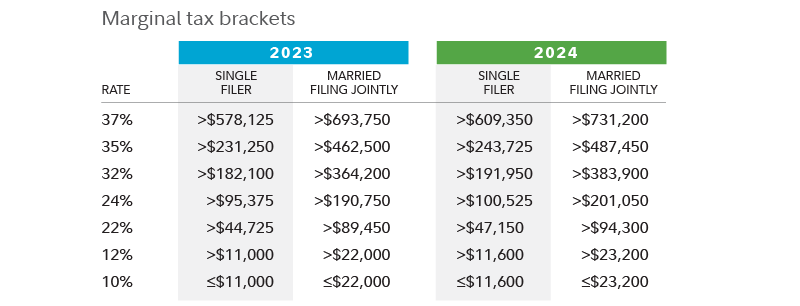

Tax Brackets in the US: Examples, Pros, and Cons

4.7 (145) · $ 25.50 · In stock

A tax bracket is a range of incomes subject to a certain income tax rate.

What is GILTI? Guide & Examples for American Entrepreneurs

Department Of Labor Has New Rules On Employee, Independent, 43% OFF

What is Regressive Tax and its Types? - Explained with Examples

Progressive tax definition & examples

Tax brackets 2024, Planning for tax cuts

:max_bytes(150000):strip_icc()/GettyImages-144560286-577404875f9b5858752b6d6d-1a80d8ccaca4477c86b8b840a36f8868.jpg)

9 States With No Income Tax

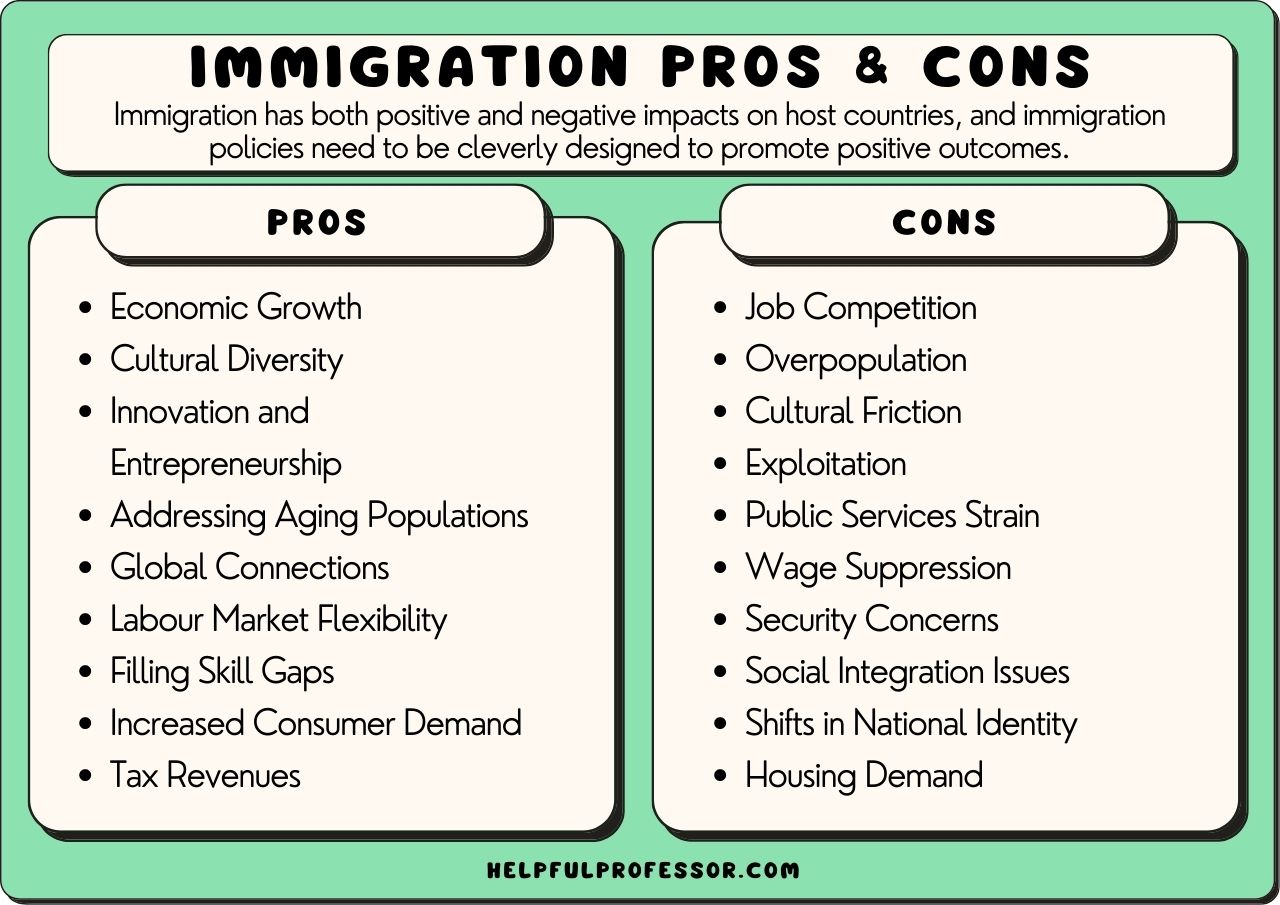

27 Immigration Pros and Cons (2024)

What are fringe benefits: pros, cons, and challenges - Sloneek®

:max_bytes(150000):strip_icc()/GettyImages-CA21828-6efa3d1061f04e47b23487ce9917a985.jpg)

Taxes Definition: Types, Who Pays, and Why

:max_bytes(150000):strip_icc()/Marginal_Tax_Rate_Final-7cae08bcc3934971b56e7650050f99f1.jpg)

Marginal Tax Rate: What It Is and How to Calculate It, With Examples

People always say that after a certain point, it's not worth working overtime anymore because of the higher tax bracket you're put in. Is this true? - Quora

:max_bytes(150000):strip_icc()/Tax_Bracket-Final-1824baf32c144f4db2f9ca7c7e8a5faa.jpg)

Tax Brackets in the US: Examples, Pros, and Cons

.webp)