Charity Auctions and Connecticut Sales Tax

4.8 (592) · $ 17.50 · In stock

Auctions are a fun way for a charity to raise money. In a Connecticut auction, the auctioneer is deemed to be the retailer for sales tax purposes. Sales

Silent Auction – 2023 NBAA Maintenance Conference

Estate Sales 06524 - Bethany, CT Estate Auctions

Tax Incentives for Artists to Donate Work to Benefit Auctions Are Almost Nonexistent

Charity 'Fur Ball' to be Held in West Hartford - We-Ha

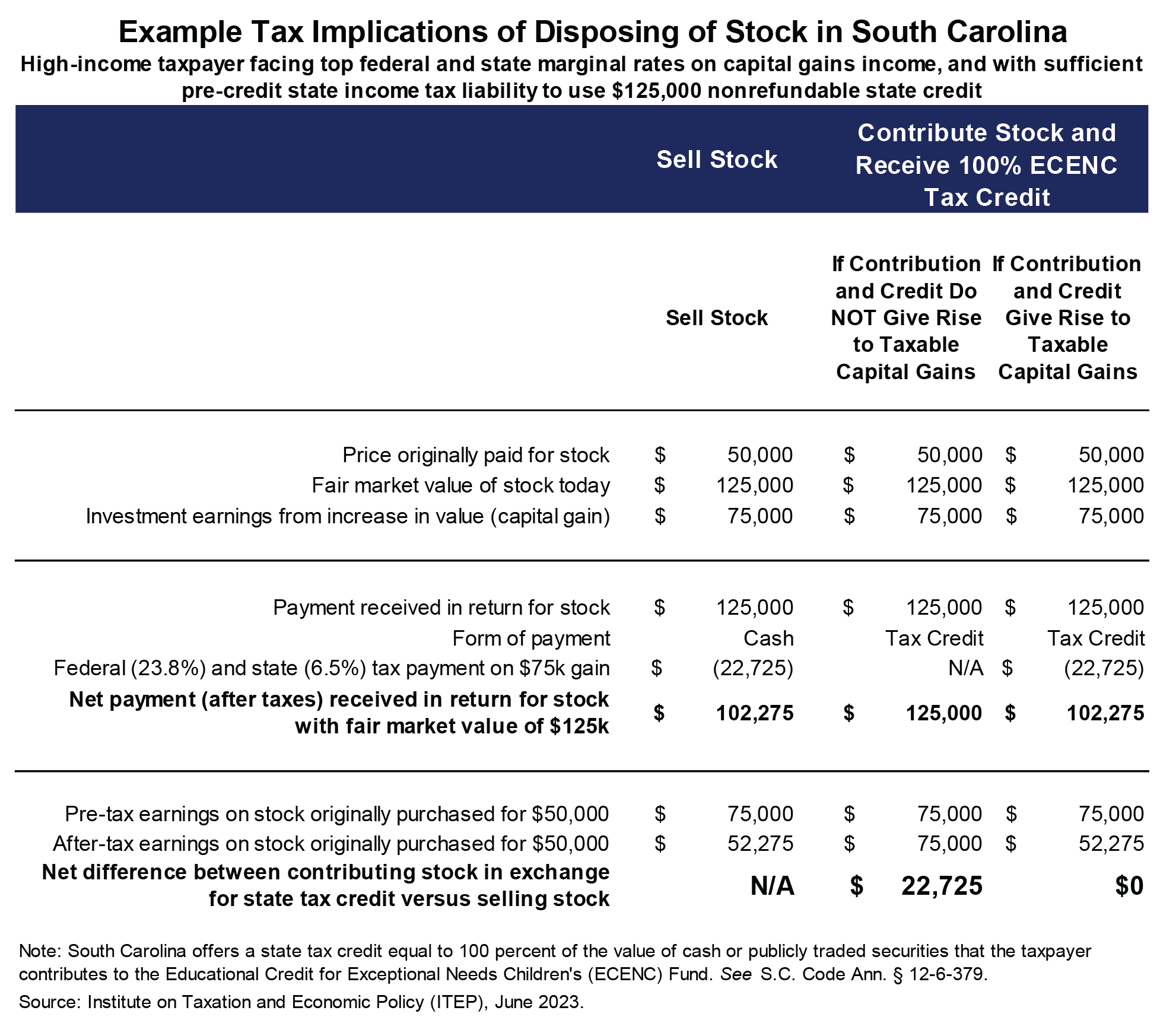

Letter to IRS on Section 1001 Regulation in 2023-2024 Priority Guidance Plan – ITEP

How To Ensure Sales Tax Compliance For Your Nonprofit Organization - Multi State Tax Solutions

Know your Laws & How they Apply to your Next Fundraiser

Connecticut Library Association - Meeting/Event Information

Program Information Archives - Connecticut Chiefs Hockey

Best Car Donation in Connecticut

2018 Car Donation Tax Questions, Answered - Car Donation Wizard

Charity Auctions and Connecticut Sales Tax

Ct Resale Certificate - Fill Online, Printable, Fillable, Blank