IRS Crypto 1099 Form: 1099-K vs. 1099-B vs. 1099-MISC

4.7 (592) · $ 17.99 · In stock

Have you received a 1099-K, 1099-B or 1099-MISC form about your crypto? Here’s what you need to know about 1099 forms and what it means for your crypto taxes.

1099 tax form, 1099

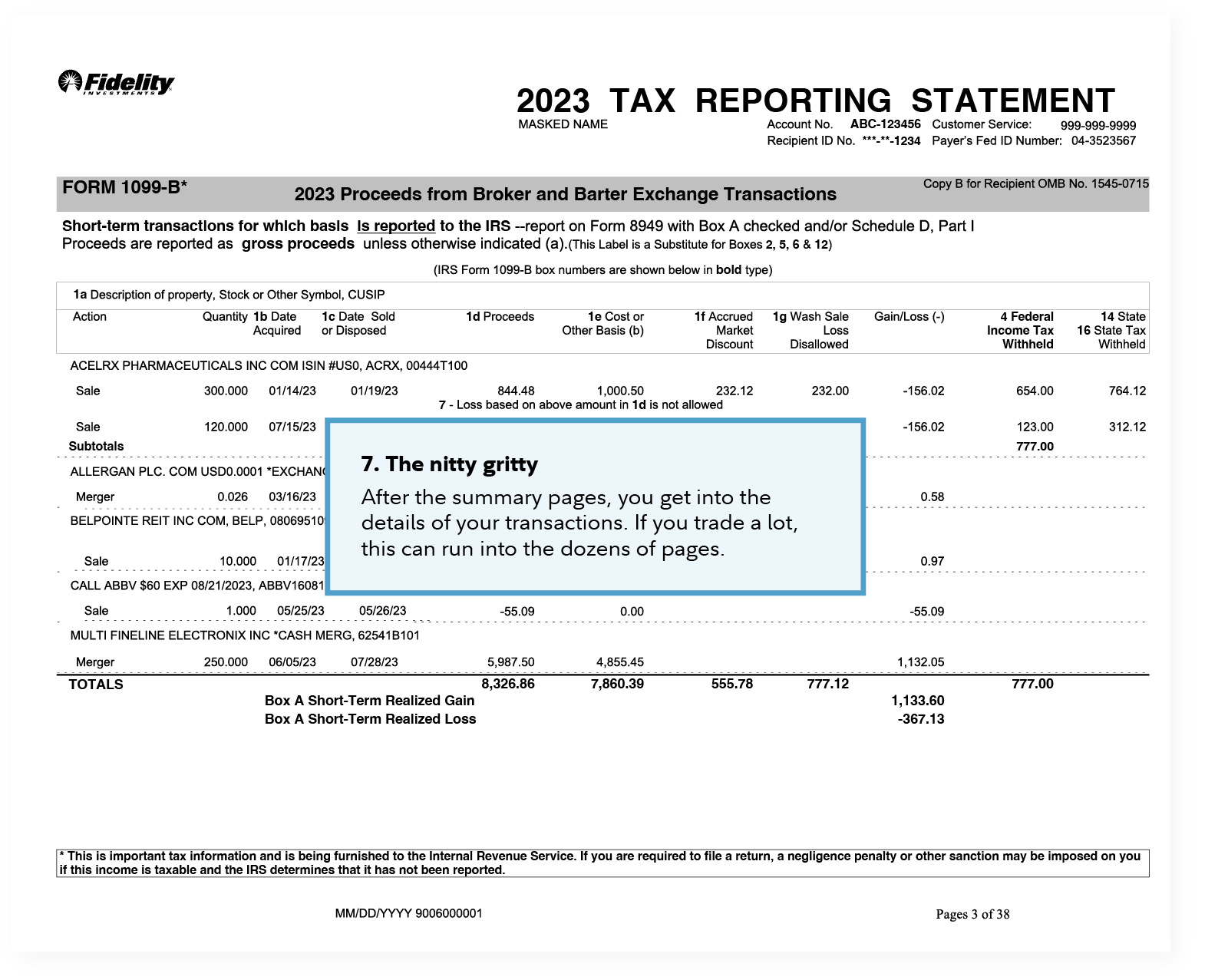

Crypto Form 1099-B: Investor's Guide 2024

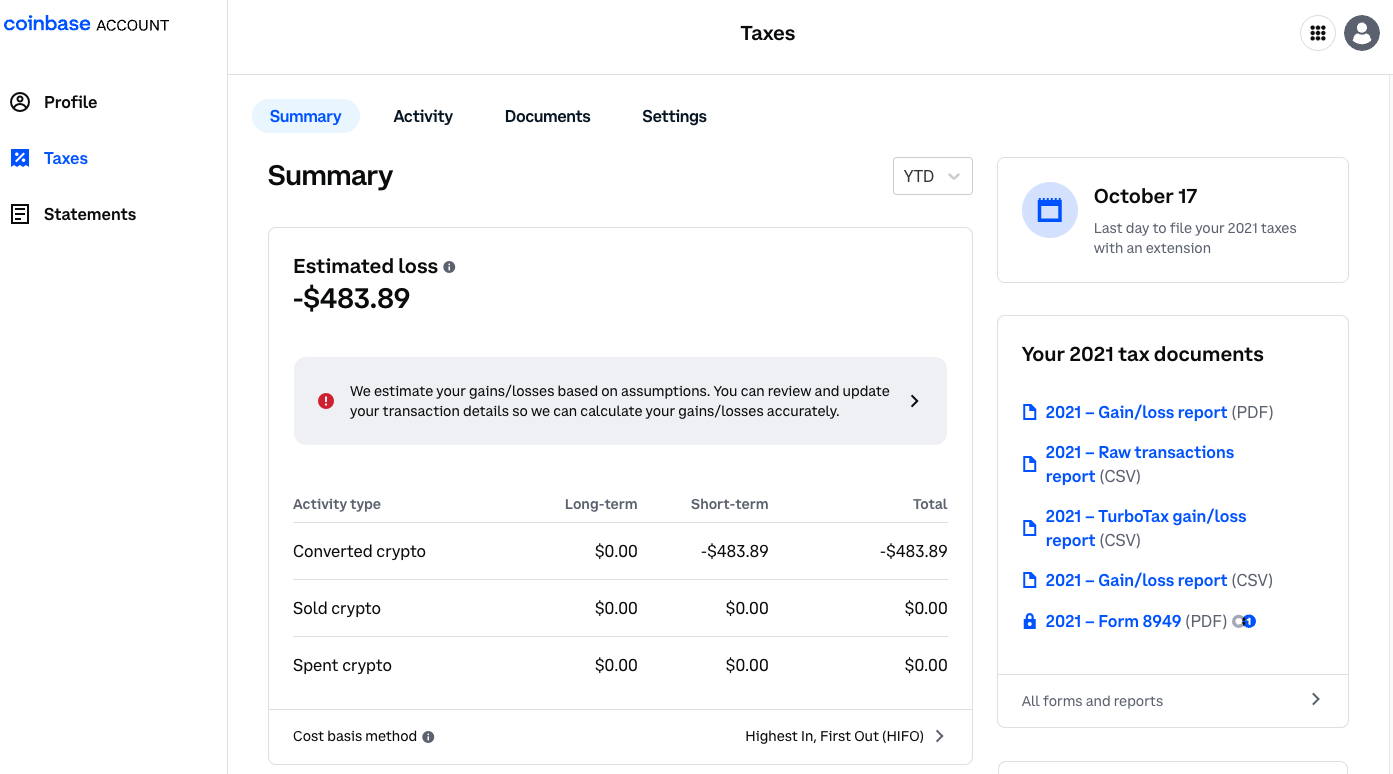

Does Coinbase Report to the IRS?

Form 1099-CAP: Changes in Corporate Control and Capital Structure Definition

Form 1099-MISC vs. 1099-NEC Differences, Deadlines, & More

How Does the IRS Know If You Owe Bitcoin and Cryptocurrency Taxes?

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

Form 1099-OID: Original Issue Discount: What it is, How it Works

A Comprehensive Guide On Form 1099-NEC For The Tax Year 2020-2021

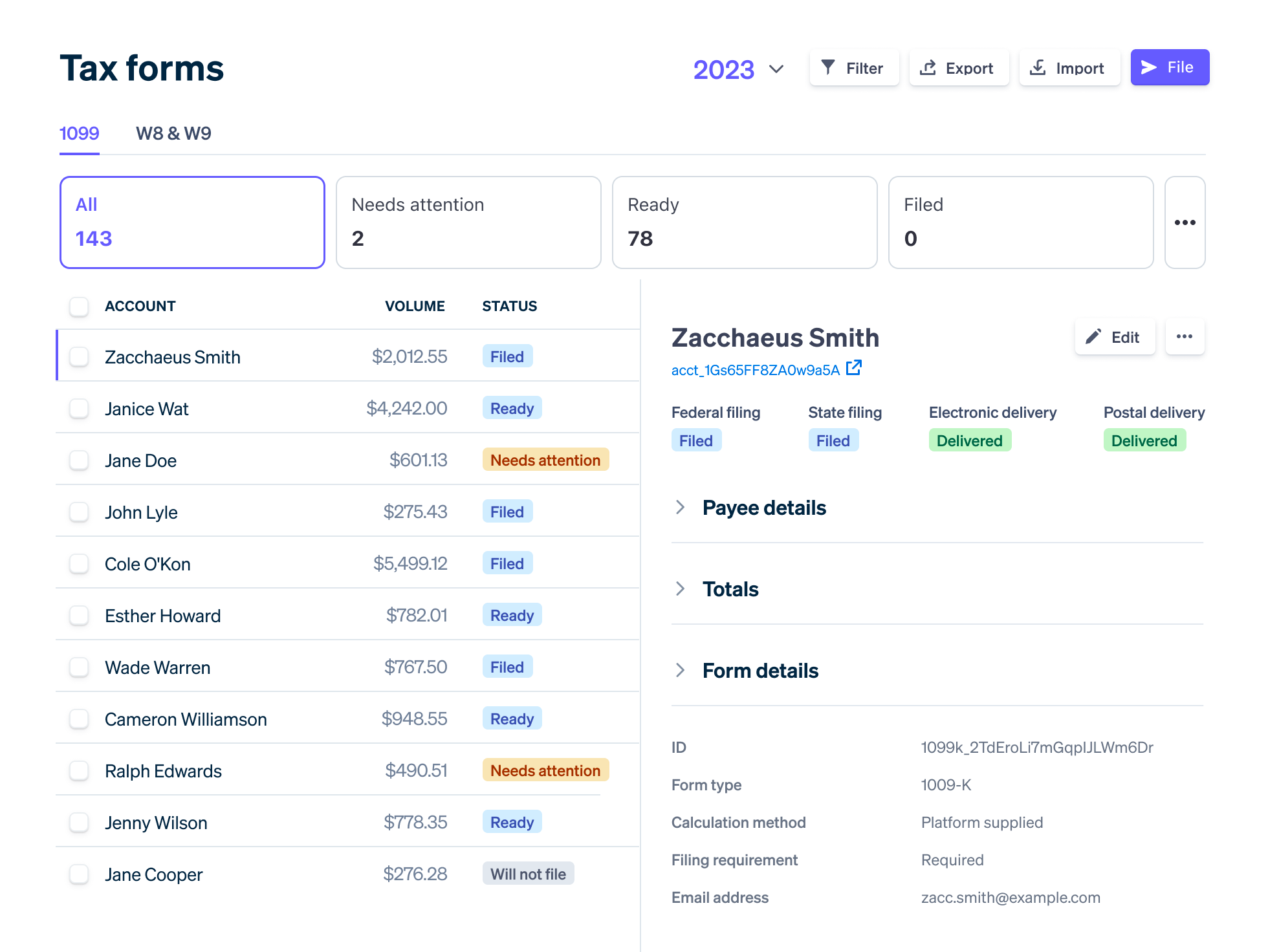

Stripe Connect: 1099

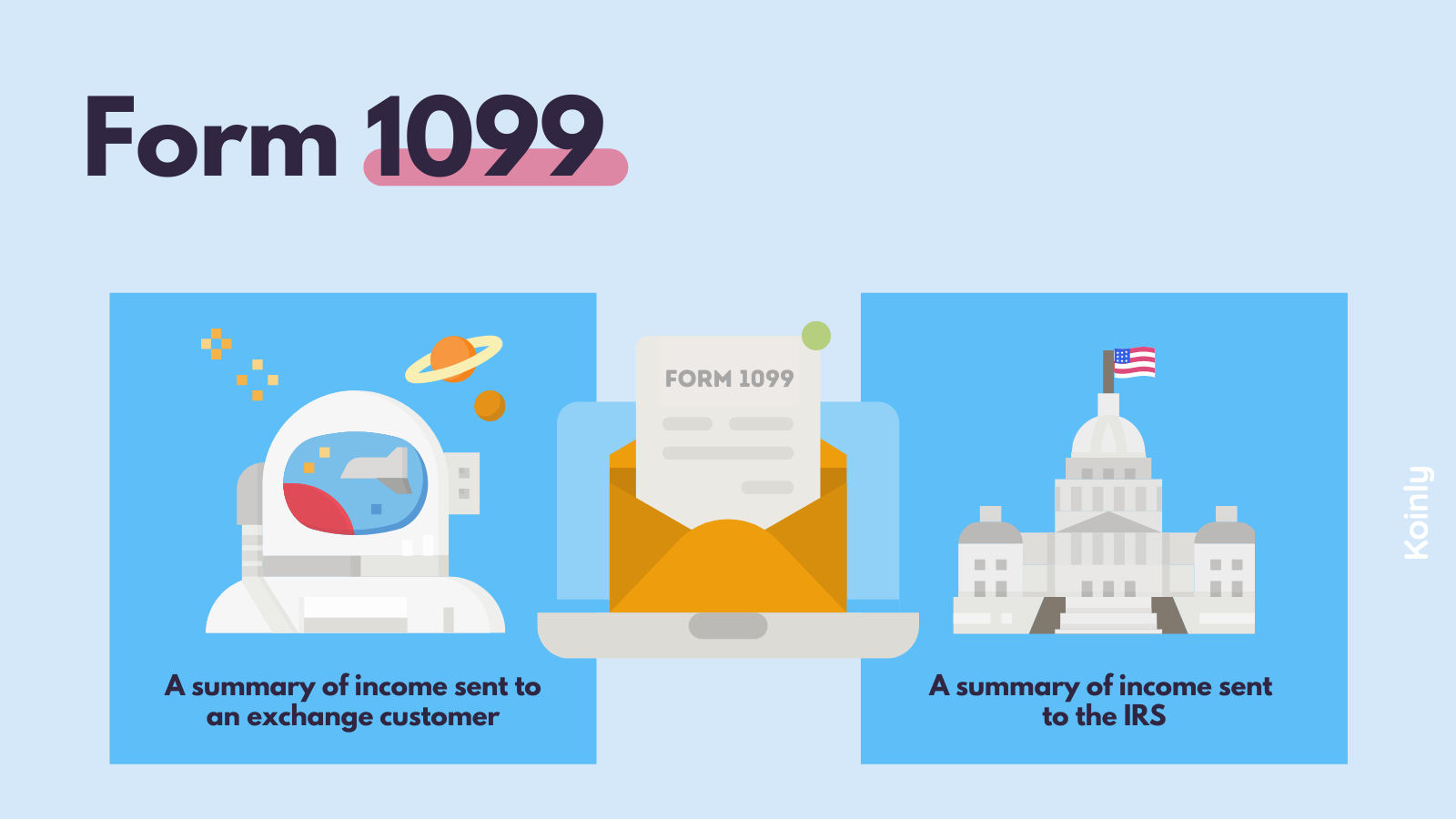

IRS Crypto 1099 Form: 1099-K vs. 1099-B vs. 1099-MISC

Planning Your Crypto Taxes? 1099-K or 1099-B, What Should You Expect from Exchanges?

Form 1099-DA: What We Know So Far

IRS Crypto 1099 Form: 1099-K vs. 1099-B vs. 1099-MISC

:max_bytes(150000):strip_icc()/1099-A-0151e1f82f624920b802b26d693d47f6.jpg)

Form 1099-A: Acquisition or Abandonment of Secured Property

Quick Guide To Filing Your 2021 Cryptocurrency & NFT Taxes

)