Low-Income Housing Tax Credits

4.8 (690) · $ 29.99 · In stock

The Low Income Housing Tax Credit (LIHTC) program was created in 1986 and is the largest source of new affordable housing in the United States. There are about 2,000,000 tax credit units today and this number continues to grow by an estimated 100,000 annually. The program is administered by the Internal Revenue Service (IRS). The […]

How the Low Income Housing Tax Credit Process Affects Access to

.png)

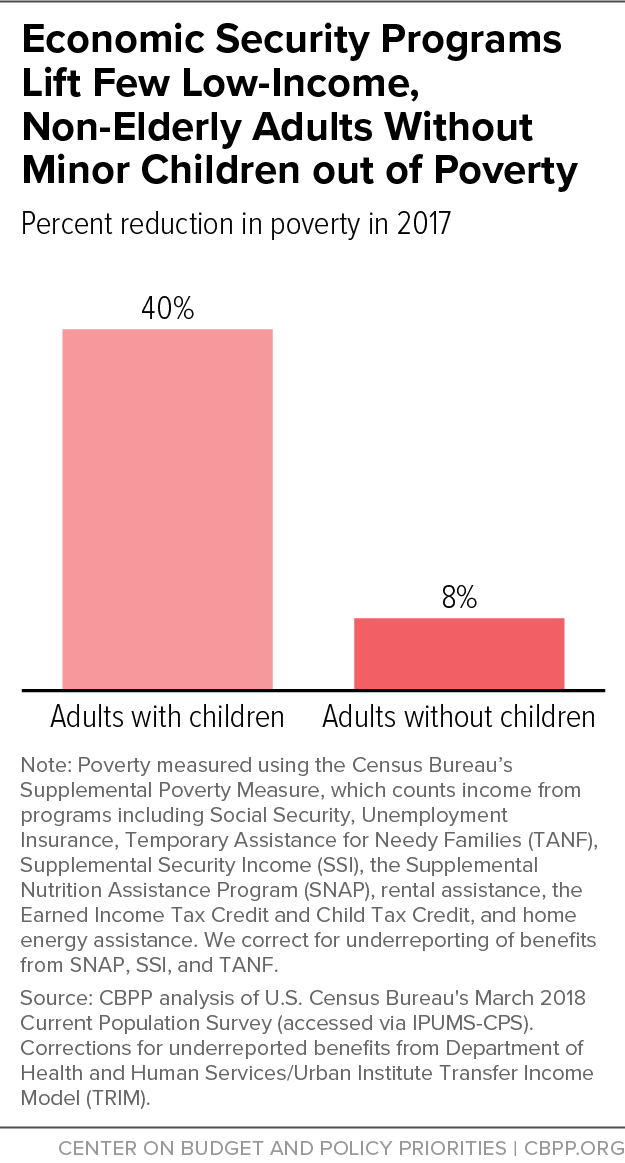

What Are Low-Income Housing Tax Credits and Why Are They Important?

The Impact of the Low-Income Housing Tax Credit in North Carolina

Improving Low Income Housing Tax Credit Data for Preservation

City of Douglas, GA on X: Developers of low to moderate-income and market-rate housing are invited to apply for the Low-Income Housing Tax Credit (LIHTC) Program. The deadline for submissions of applications

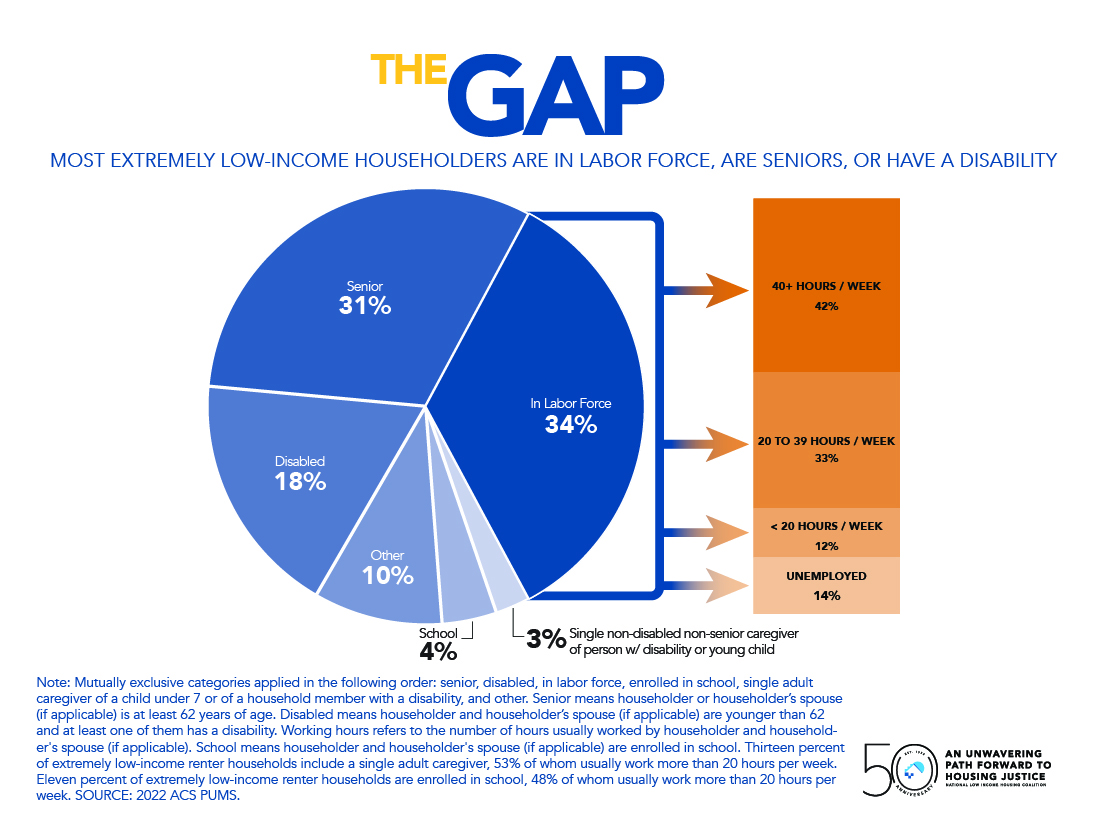

The Impact of Low-Income Housing Tax Credits on Affordable Housing

G.A. Haan Development - Low-Income Housing Tax Credits The Low-Income Housing Tax Credit (LIHTC) is the most important resource for creating affordable housing in the United States today. The LIHTC database, created

Affordable Housing Tax Credit Coalition

LIHTC for Regular People — Shelterforce Shelterforce

Revisiting the economic impact of low-income housing tax credits

Walker Dunlop

Low income housing tax credits and neighborhood change : case study of three projects in Indianapolis

Gary Cohen Presents on Low Income Housing Tax Credits: Shutts