Nasdaq 100 Collar 95-110 ETF (QCLR)

4.6 (778) · $ 17.99 · In stock

The Global X Nasdaq 100 Collar 95-110 ETF (QCLR) employs a collar strategy for investors seeking range-bound equity returns. QCLR seeks to

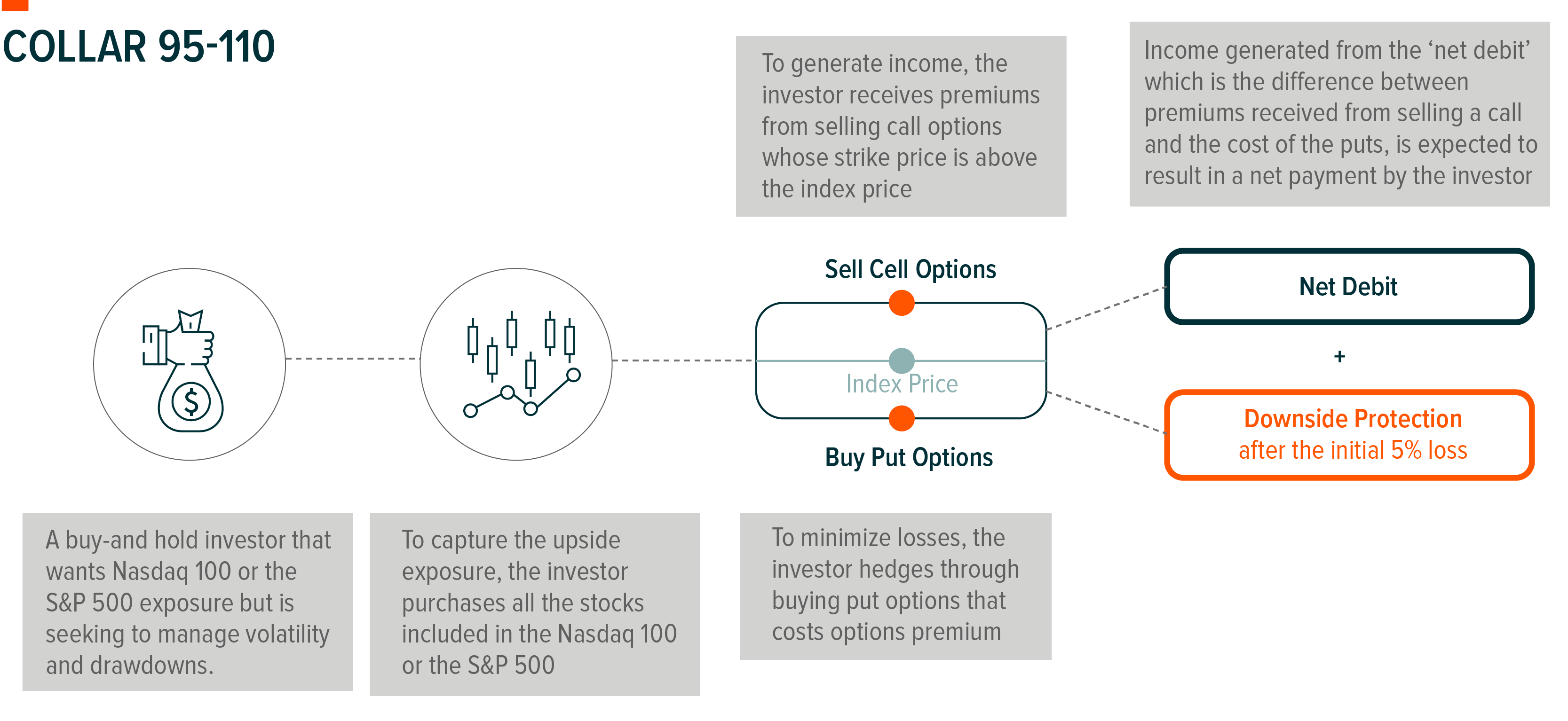

Options Collar Strategies as a Risk Management Tool – Global X ETFs

Using Options Strategies in a Rising Rate Environment

EDGAR Filing Documents for 0001432353-24-000130

The Case for Managing Risk with Collar ETFs – Global X ETFs

DIVO ETF: A Must-Own For Income-Seeking Investors

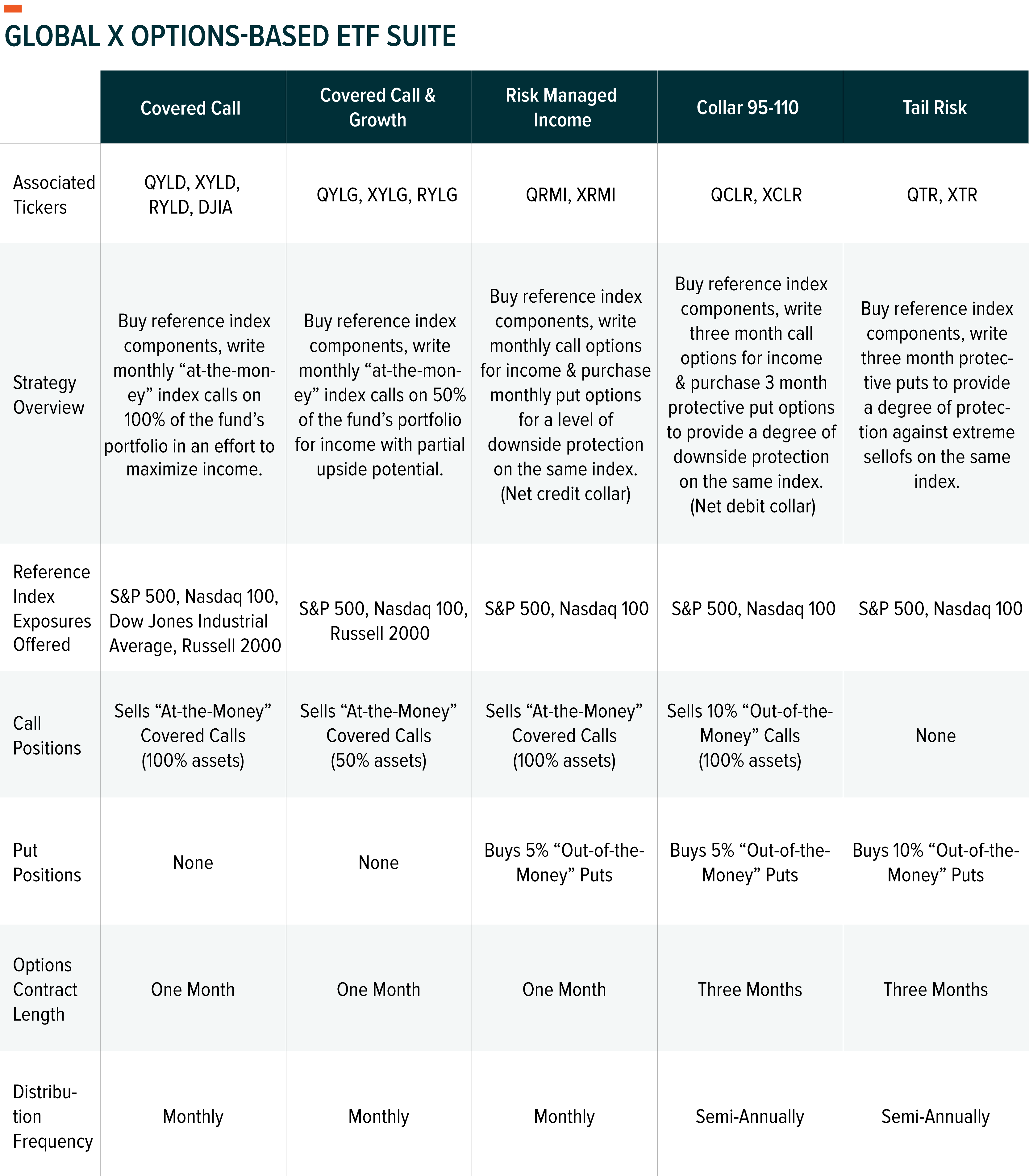

Global X Launches Six Options-Based ETFs for Current Market

Global X Launches Six Options-Based ETFs for Current Market

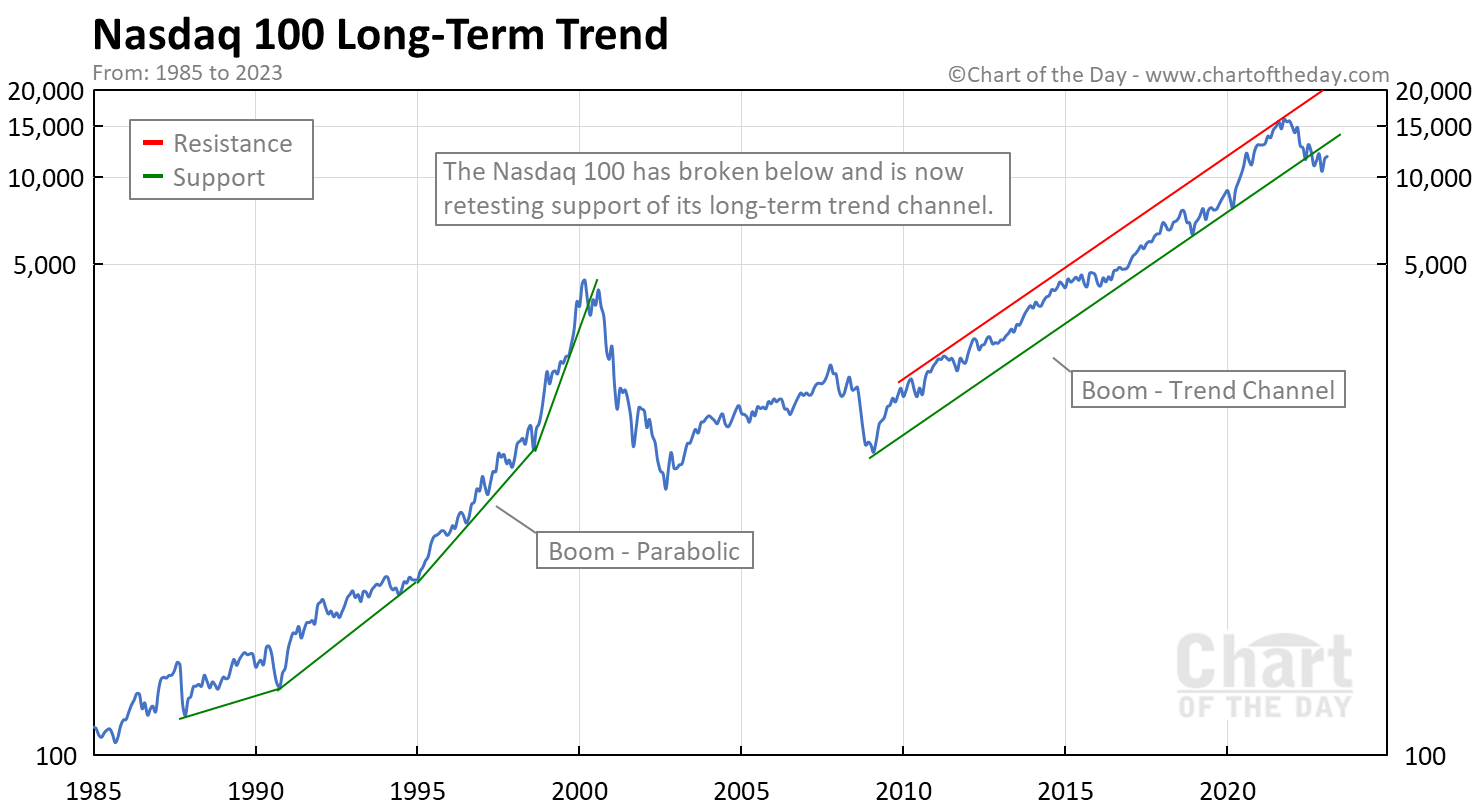

Which NDX ETF is Right for You?

business Archives - Revere Securities LLC

B of A Securities Maintains Mercadolibre (MELI) Buy Recommendation

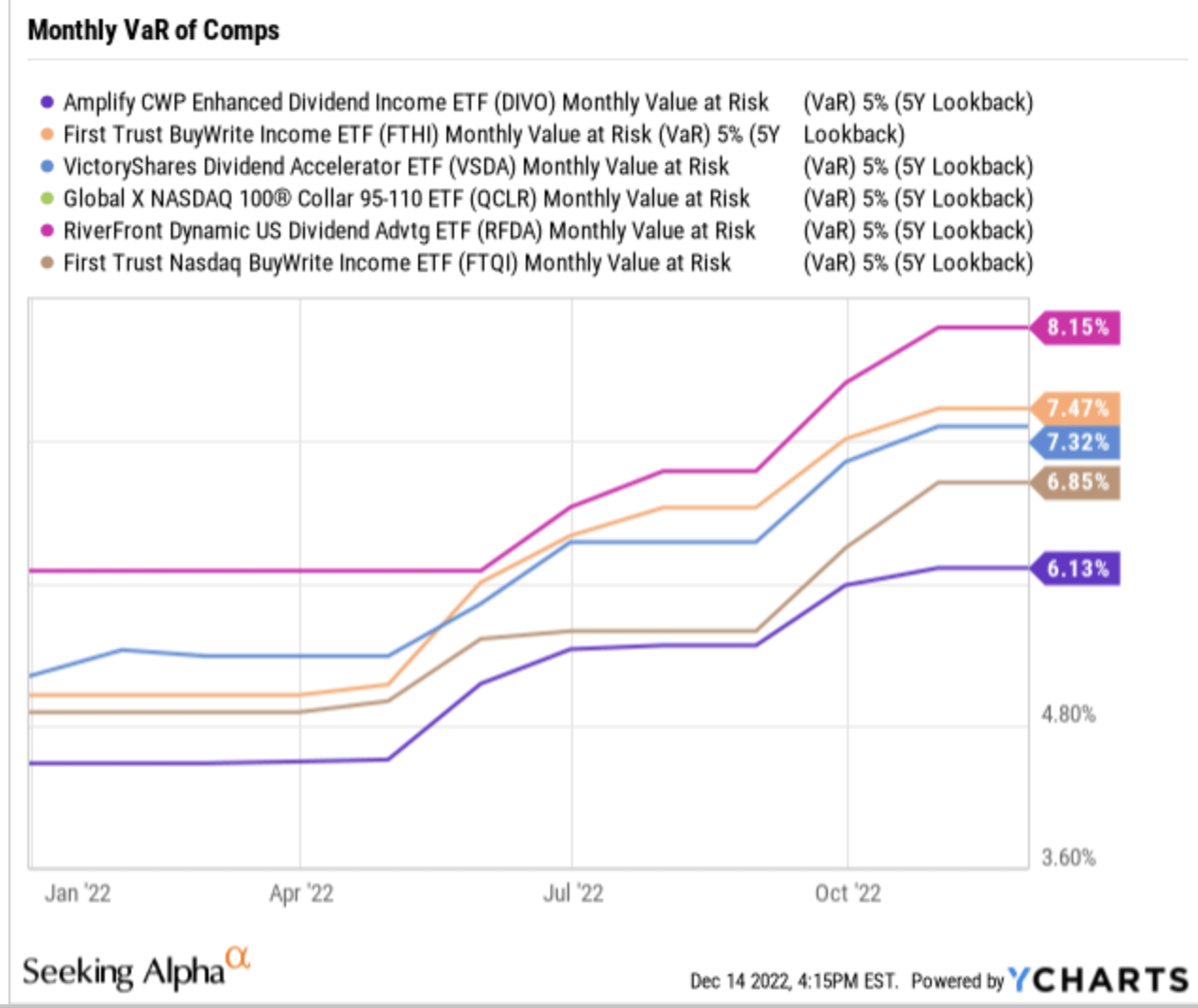

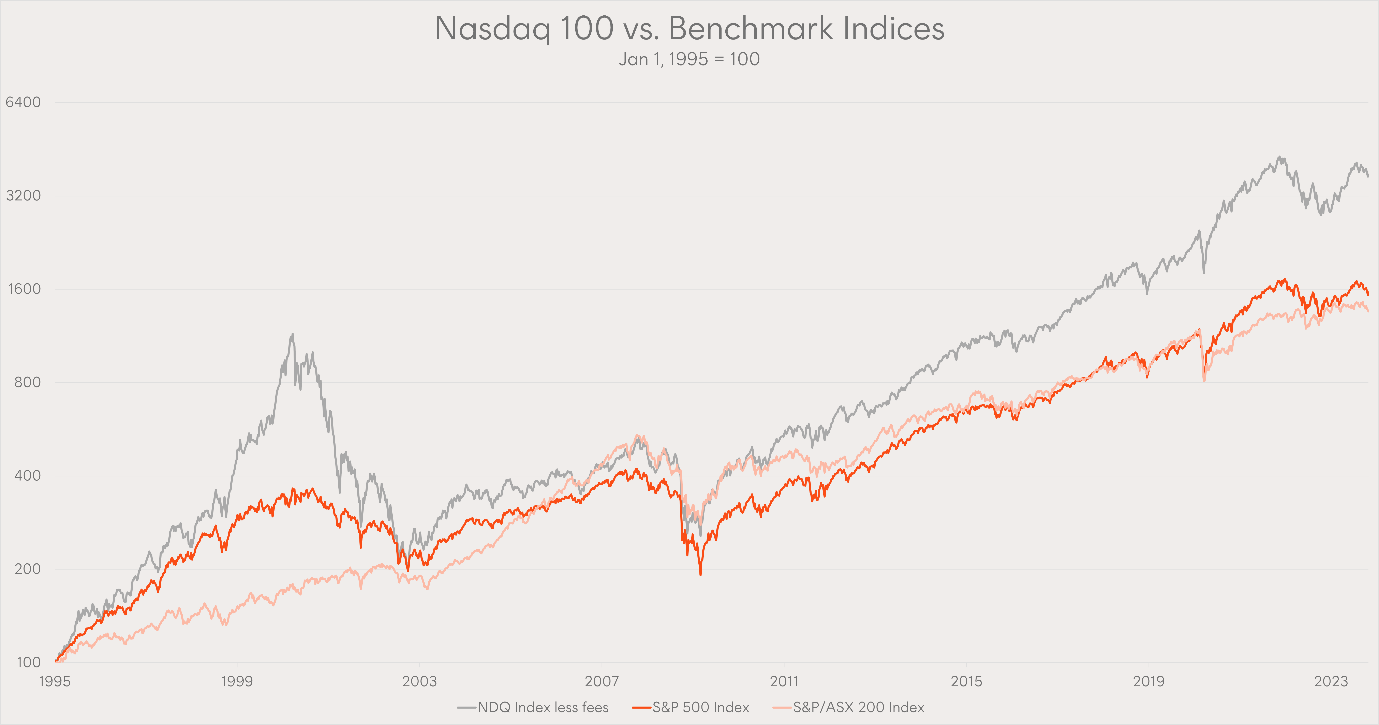

NUSI vs. QCLR: Comparing Two Defensive Derivative-Based ETFs - ETF Focus on TheStreet: ETF research and Trade Ideas

The Case For Managing Risk With Collar ETFs

ETF Industry KPI – 8/30/2021 – ETF Think Tank

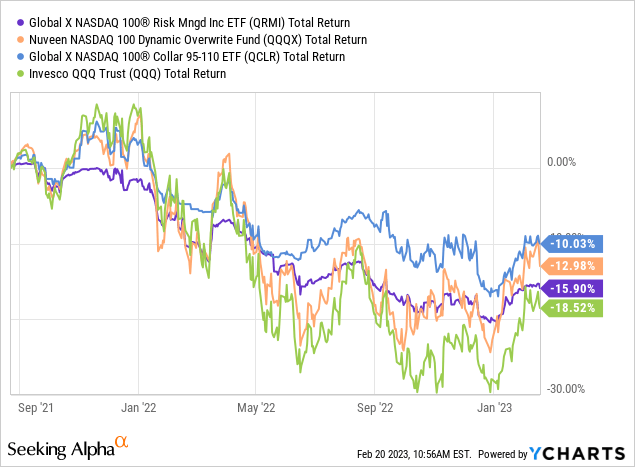

XRMI Vs. QRMI: Two Risk-Managed ETFs Have Not Proved Themselves (Yet)

Global X Nasdaq 100 Collar 95-110 Etf Share Price: QCLR (Global X Nasdaq 100 Collar 95-110 Etf) Stock Price Today & Updates

:max_bytes(150000):strip_icc()/GettyImages-1497608143-9a7e0705d0d84429b4225003c3dcd5e2.jpg)