Non-Profit Organizations, Ohio Law, and the Internal Revenue Code

4.7 (453) · $ 10.00 · In stock

The relationship and interaction between Ohio law governing not-for-profit organizations and the Internal Revenue Code provisions governing tax-exempt and charitable organizations can be confusing and often misunderstood. Many people assume that one necessarily means the other, which is not the case.

Free Nonprofit Bylaws Free to Print, Save & Download

Electing Pass-Through Entity: IT 4738

What You Should Know About Sales and Use Tax Exemption Certificates, Marcum LLP

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was About $28 Billion in 2020

Pass-Through Entities & Fiduciaries - Withholding Tax Return (IT 1140)

Ohio REALTORS Ohio's Real Estate Trade Organization

THE Foundation #1 NIL for Ohio State

Nonprofit Compliance Guide, Harbor Compliance

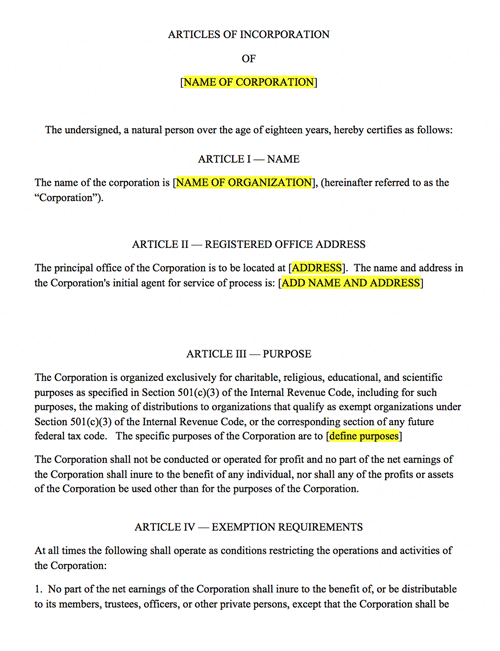

Nonprofit Articles of Incorporation, Harbor Compliance

Nonprofit Governance by State, Harbor Compliance