Marks and Spencer: High-Yield Stock In Retail Given Balanced Risks

5 (494) · $ 6.50 · In stock

Marks and Spencer stock has a strong market position in the consolidated non-cyclical industry. See why M&S remains the best option to buy in the retail bond universe.

Marks and Spencer stock has a strong market position in the consolidated non-cyclical industry. See why M&S remains the best option to buy in the retail bond universe.

Retail Therapy: Why the Retail Industry is Broken – and What Can Be Done to Fix It: 9781472965103: Pilkington, Mark: Books

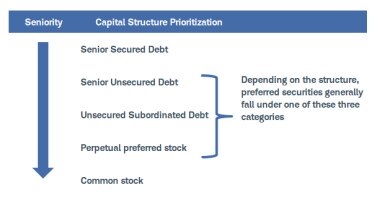

Preferred Securities: Balancing Yield with Risk

A Gap That Isn't Worth Minding Much, Insights

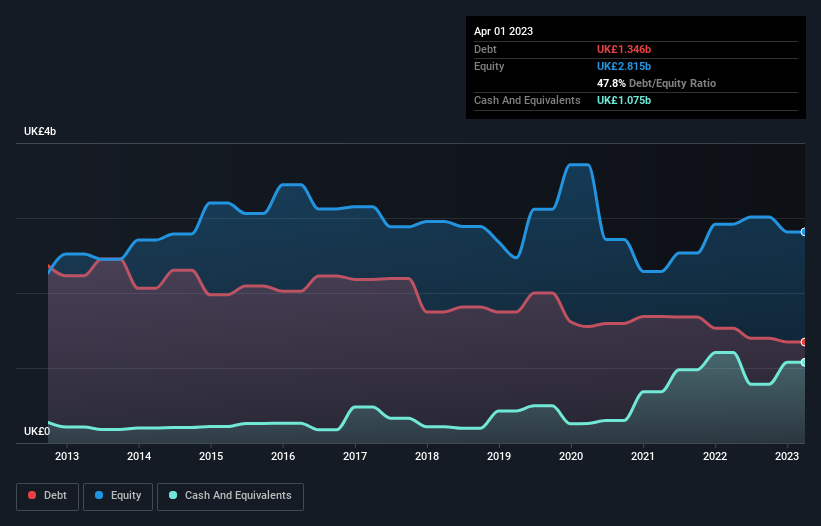

Marks and Spencer Group (MKS) Balance Sheet & Financial Health Metrics - Simply Wall St

Marks & Spencer Earnings: Shares Surge

Hackers impersonate Marks and Spencer CEO Steve Rowe in gift voucher scam, 2020-10-21

Marks and Spencer will shut 67 shops over next five years to save £300m

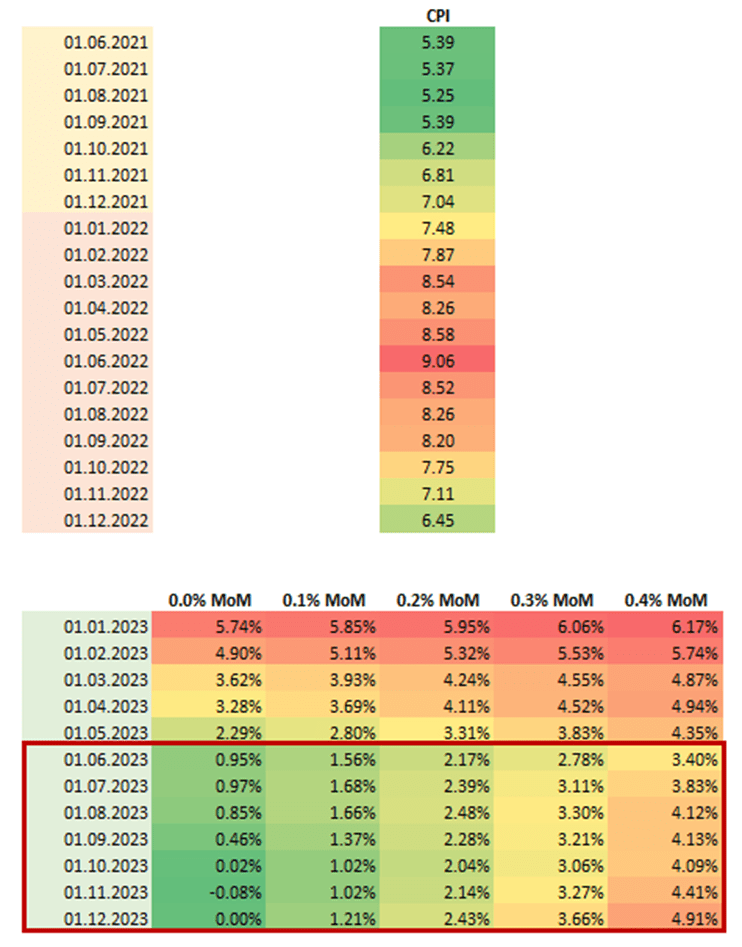

Marks and Spencer: High-Yield Stock In Retail Given Balanced Risks In Recession Year

Fed Balance Sheet FAQs - Joseph Wang

M&S Drop Points to Tougher Year for 2023's Top-Performing Sector - Bloomberg

18 Charts That Say Long-term Opportunity in Stock Market

tcs: TCS set to close new deals worth $1 billion with Marks & Spencer - The Economic Times