Tax Credits for Individuals and Families

4.9 (643) · $ 20.50 · In stock

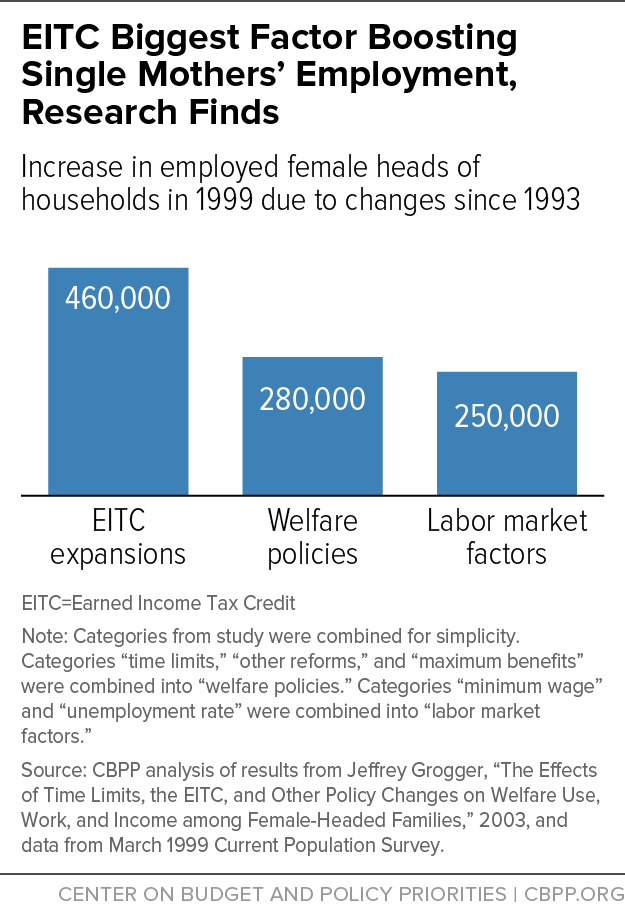

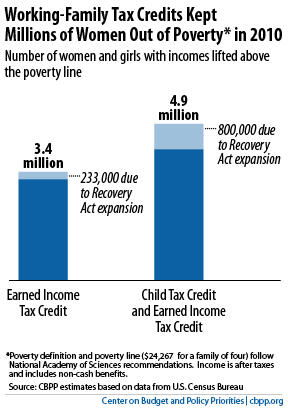

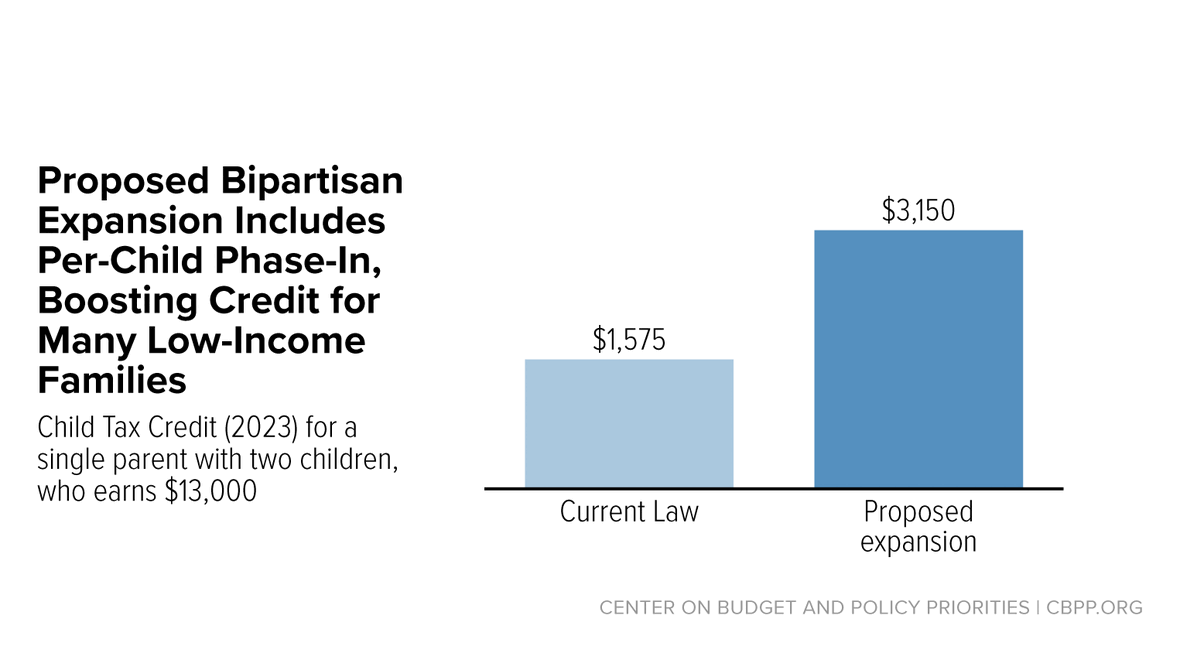

The Earned Income Tax Credit (EITC) encourages and rewards work for low- and moderate-income working people, while the Child Tax Credit helps families offset the cost of raising children.Together, the EITC and the low-income piece of the Child Tax Credit benefit 30 million households with low incomes, lifting 10 million people above the poverty line. We work to highlight the benefits of these credits and to protect and expand them to further reduce poverty.

The Benefits Of Allotment Communities For Individuals And Families

The Affordable Care Act: Transforming Healthcare Accessibility in

The Benefits Of Allotment Communities For Individuals And Families

Republican Tax Credit Proposal Would Provide New Breaks to Tax

Earned Income Tax Credit (EITC) and Other Tax Credits

Benefits of Expanding Child Tax Credit Outweigh Small Employment

Maximize Your Savings: Tax Deductions 2023 Comprehensive Guide

Federal Tax Credit - FasterCapital

A Simple Guide to Affordable and Accessible Healthcare: Ayushman

EITC and Child Tax Credit Promote Work, Reduce Poverty, and

Tax Credits for Working Families Help Women Now and Later

The speech from the throne

Tax Credits for Individuals and Families

:max_bytes(150000):strip_icc()/a-low-residue-diet-pros-cons-and-what-you-can-eat-5187250-a-cf4fad7253994582a1b68dadd7e335d4.png)