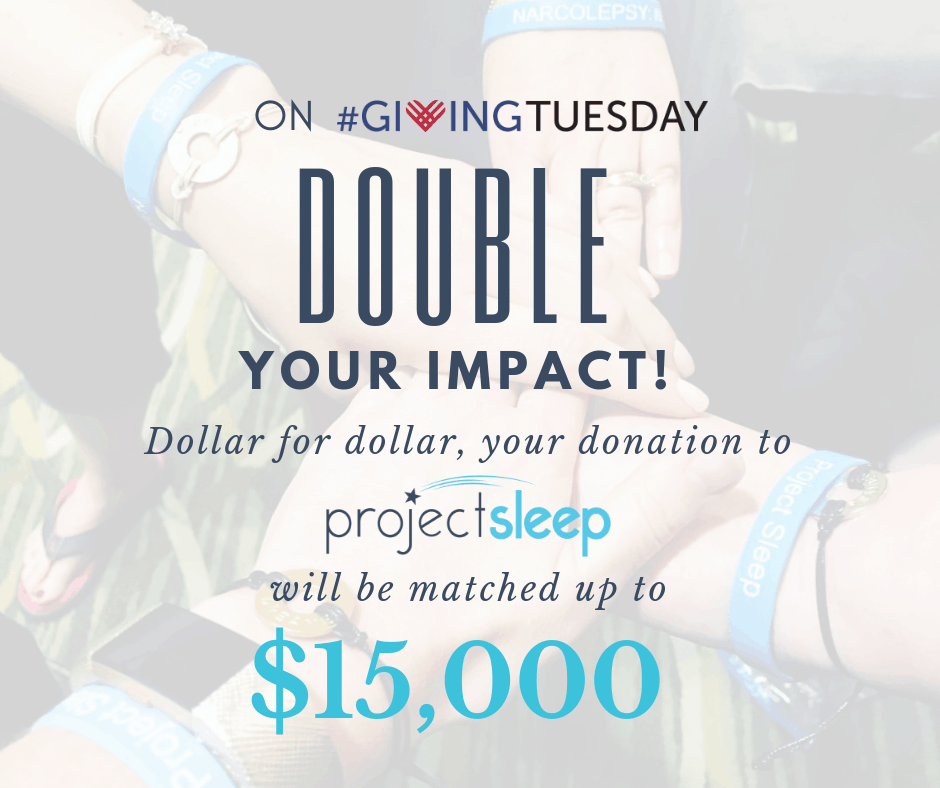

What Double Taxation Is and How It Works

4.7 (331) · $ 7.00 · In stock

Double taxation refers to income taxes paid twice on the same income source. It occurs when income is taxed at both the corporate and personal level, or by two nations.

:max_bytes(150000):strip_icc()/State_corporate_tax_rate-d913771f47104ed6a746341ed611ce54.jpg)

Throwback Rule: What It Is, How It Works

:max_bytes(150000):strip_icc()/curved-skyscraper-against-blue-sky-969510128-f7395d8e1cac42329e854a0061a4aa4a.jpg)

Bilateral Tax Agreement: What It Is, How It Works

The Top 10 European Tax Havens

:max_bytes(150000):strip_icc()/miniature-people-looking-future-with-stack-coin-about-financial-and-money-savings-concept--693991546-2bd592a153bc44928eb35e0ae5e07685.jpg)

Dividend Exclusion: What It Is and How It Works for Corporations

:max_bytes(150000):strip_icc()/panorama-of-cityscape-image-of-sydney--australia-with-harbour-bridge-and-sydney-skyline-during-sunrise--1028278130-f7079060bdfe49289aa041350d4f4bc5.jpg)

Dividend Imputation: What it is, How it Works, Around the World

:max_bytes(150000):strip_icc()/accelerated-dividend.asp-Final-1351b4a6e8064ad39dfc51e0b202da34.png)

Accelerated Dividend Definition

:max_bytes(150000):strip_icc()/GettyImages-520944554-288b89e34b184244868b318778b0a9ab.jpg)

Throwback Rule: What It Is, How It Works

Julia Kagan's Instagram, Twitter & Facebook on IDCrawl

:max_bytes(150000):strip_icc()/business-executives-discussing-in-office-meeting-997745894-9e19b97892a34b509370afeff80663f9.jpg)

Can a Corporation Deduct Dividend Payments Before Its Taxes Are Calculated?

:max_bytes(150000):strip_icc()/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Julia Kagan's Instagram, Twitter & Facebook on IDCrawl

:max_bytes(150000):strip_icc()/GettyImages-157311328-bcaab1c8780a4482bd66ac8e62faf077.jpg)

Expatriate (Expat): Definition, With Pros/Cons of Living Abroad

:max_bytes(150000):strip_icc()/shutterstock_221245621-5bfc2b32c9e77c0026b4e96b.jpg)

Advance Corporation Tax (ACT): What It Is, How It Works

:max_bytes(150000):strip_icc()/125183558-5bfc2b8c46e0fb00517be02c.jpg)

183-Day Rule: Definition, How It's Used for Residency, and Example

:max_bytes(150000):strip_icc()/GettyImages-961759390-5fefa7255496419eac06790964e0b2b8.jpg)

The Top 10 European Tax Havens

:max_bytes(150000):strip_icc()/double_taxation.asp-final-3d97801e71d649c28bebdbc3313a038e.png)