What Is Form 8586: Low-Income Housing Credit - TurboTax Tax Tips & Videos

5 (377) · $ 24.99 · In stock

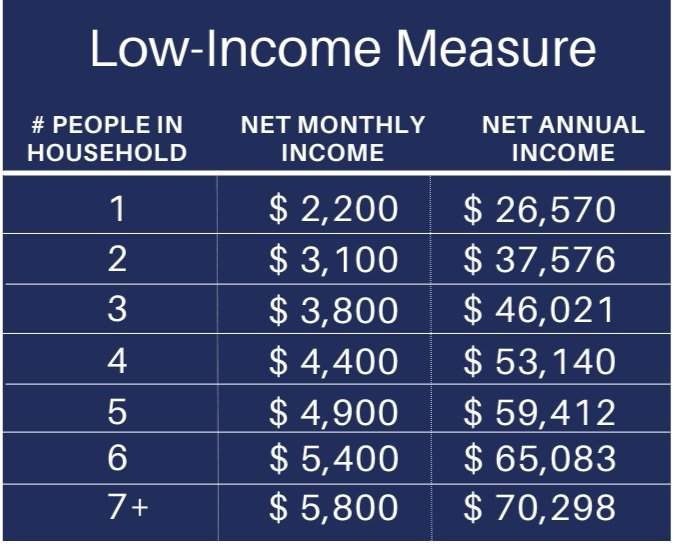

General business tax credits provide incentives for business activities beneficial to the American public or the economy in general. Owners of rental buildings in low-income housing projects may qualify for the low-income housing credit, which is part of the general business tax credit, using Form 8586 to calculate the amount of the credit.

TurboTax® Live Assisted Premium 2023-2024

TurboTax Premier Federal + State + Federal efile 2009

TurboTax® Deluxe Desktop 2023-2024

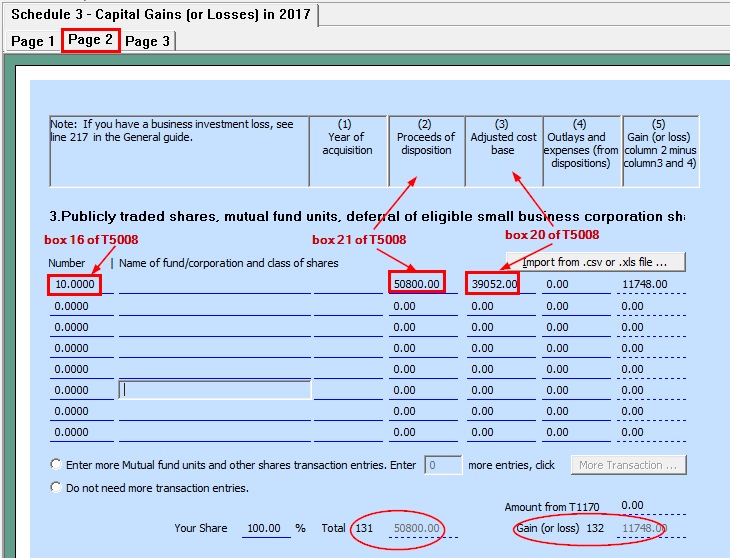

myTaxExpress and T2Express FAQs - How to report T5008 slip?

:max_bytes(150000):strip_icc()/GettyImages-1137410599-27899a879c9b470aba0c43f8790870ad.jpg)

General Business Credit (GBC): What it is, How it Works

TurboTax® Premium Online 2023-2024

20200227 094321 by News & Review - Issuu

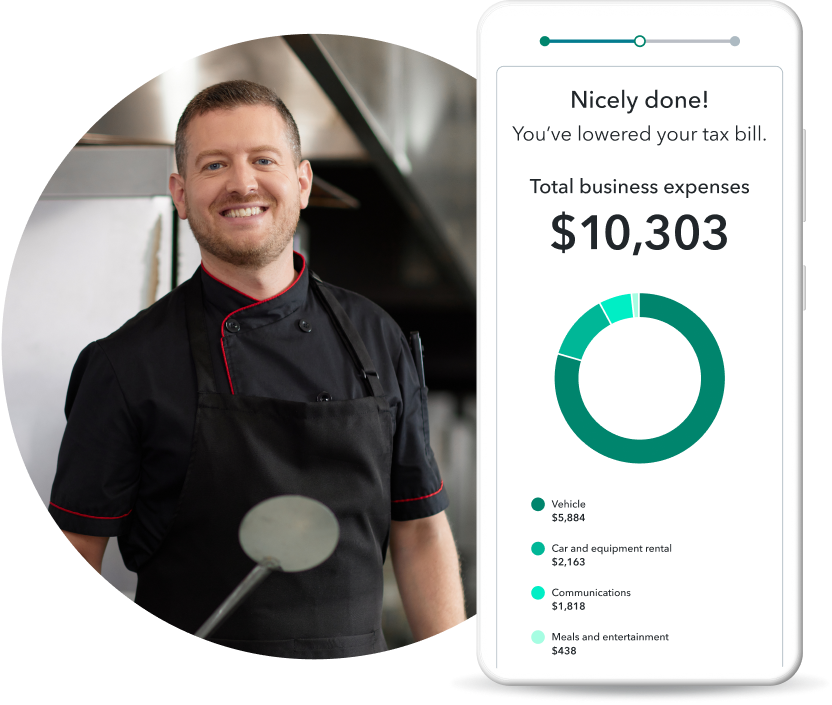

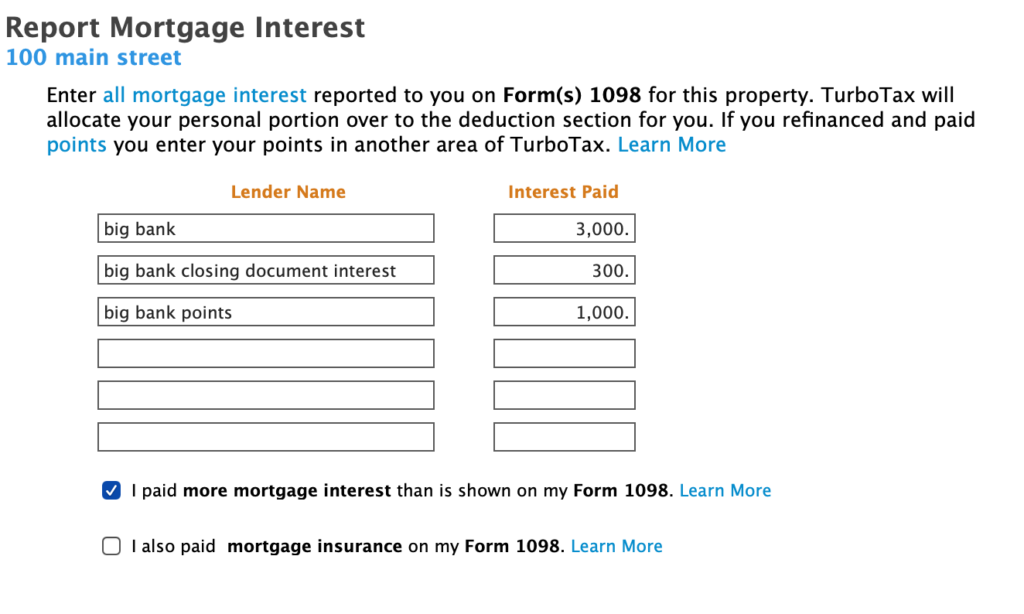

File Your Vacation Property Taxes with Intuit TurboTax - Renting A

IRS Form 8586 Walkthrough (Low-Income Housing Credit)

What Is Form 8586: Low-Income Housing Credit TurboTax Tax, 55% OFF