Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

4.7 (470) · $ 35.00 · In stock

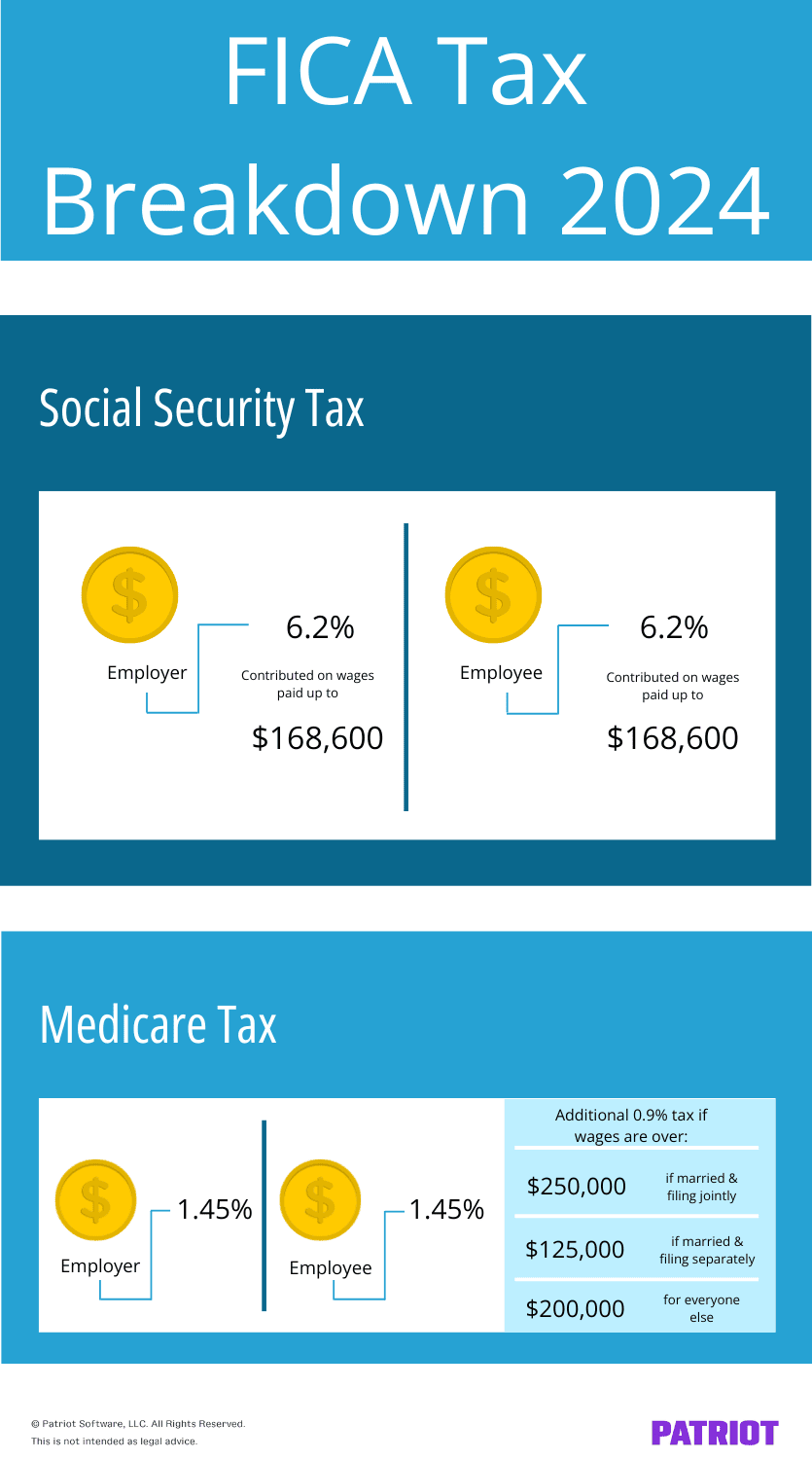

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

Trends in Corporate Economic Profits and Tax Payments, 1998 to 2017

Increasing Payroll Taxes Would Strengthen Social Security

Working After Retirement: Rules, Benefits, & Social Security

What is a payroll tax?, Payroll tax definition, types, and

The Peter G. Peterson Foundation on LinkedIn: Should We Eliminate

The FICA Tax: How Social Security Is Funded – Social Security

Dan Tumis (@Dtumis41) / X

AARP - You can request federal tax withholding from your Social Security at rates of 7%, 10%, 15% or 25% by completing the IRS form W-4V and sending it to your local

What Impact Would Eliminating the Payroll Cap Have on Social Security?

Should You Make Pre-tax or Roth 401(k) Contributions?

Bill Monte, CLU® , ChFC®, CLTC®, LTCP®, RICP® on LinkedIn: Should

Why Is There a Cap on the FICA Tax?, fica tax

500 Reasons to Eliminate Social Security's Tax Cap - CPA Practice Advisor

Pros & Cons of President Trump's Payroll Tax Deferral

Overview of FICA Tax- Medicare & Social Security, fica tax